SB 275 STRATEGIC BITCOIN RESERVE ACT

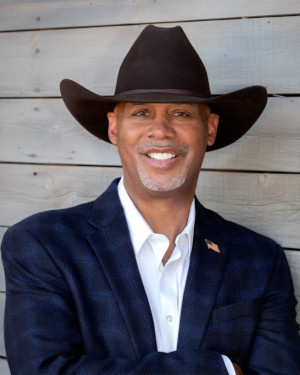

Sponsored By: Sen Anthony (Ant) L Thornton

Actions: [4] STBTC/SFC-STBTC API.

Scheduled: Not Scheduled

Senate Bill 275 (SB 275) enacts the Strategic Bitcoin Reserve Act, allowing the state treasurer and state investment council to invest in bitcoin as part of the state’s permanent funds. The bill establishes investment parameters, secure custody requirements, and limits on total bitcoin holdings. It also creates a process for accepting taxes and fees in bitcoin, converting non-bitcoin digital assets, and permitting bitcoin lending under specified conditions. SB 275 takes effect July 1, 2025.Legislation Overview:

Senate Bill 275 (SB 275) establishes a state-controlled investment strategy for bitcoin, permitting the state treasurer and the state investment council to invest in bitcoin through the Land Grant Permanent Funds, Severance Tax Permanent Fund, Tobacco Settlement Permanent Fund, and other state-designated funds. The bill caps bitcoin investments at 5% of total fund value and allows bitcoin holdings to be stored through secure custody solutions, qualified custodians, or exchange-traded products regulated by federal agencies. The bill defines “bitcoin” as the decentralized digital currency launched in 2009, while “digital asset” includes cryptocurrencies, stablecoins, and other electronic assets. The bill establishes secure custody requirements that require private keys to remain in encrypted environments with multiparty governance structures and disaster recovery protocols. The bill allows bitcoin to be used for state tax and fee payments, requiring conversion of all non-bitcoin digital assets to either bitcoin or U.S. currency within 60 days of receipt. It also permits bitcoin lending, provided that such loans do not increase financial risk to the state. The state treasurer must issue rules for managing lending transactions and ensuring compliance with risk management standards. The bill authorizes retirement funds held by the Public Employees Retirement Board and the Educational Retirement Board to invest in exchange-traded bitcoin products regulated by the Securities and Exchange Commission, the Commodity Futures Trading Commission, or the state’s securities division. Implications Bitcoin is a decentralized digital currency that allows people to send and receive money without relying on banks or governments. It was created in 2009 as an alternative to traditional currencies and operates on a blockchain, which is a secure, public ledger that records all transactions. Unlike traditional money, bitcoin is not controlled by any country or financial institution and has a limited supply of 21 million coins, making it resistant to inflation. People can buy, sell, and store bitcoin using digital wallets, and transactions are verified through a process called mining, where powerful computers solve complex puzzles to add new transactions to the blockchain. Bitcoin is often used as an investment, a way to transfer money globally, or as a hedge against inflation, but its price can be highly volatile, meaning its value can rise and fall quickly. SB 275 positions New Mexico as one of the first states to integrate bitcoin into its long-term investment strategy, potentially benefiting from bitcoin price appreciation. However, bitcoin’s price volatility, regulatory uncertainty, and security risks could impact fund stability. The 5% investment cap limits exposure, but risk remains, particularly if bitcoin prices decline significantly. The ability to accept taxes and fees in bitcoin introduces complexities in tax administration and conversion mechanisms, requiring secure exchange processes to ensure that state revenues remain stable. The bill’s secure custody provisions provide safeguards, but ongoing cybersecurity risks and private key management concerns may present challenges in execution. Bitcoin lending provisions could generate additional revenue, but such transactions must be carefully managed to prevent financial losses due to counterparty risk or market instability. Retirement fund investment authorization diversifies asset holdings, but may face opposition from pension beneficiaries concerned about investment risk. The state treasurer’s rulemaking authority will play a key role in determining risk mitigation strategies, ensuring compliance with federal and state regulations, and safeguarding public assets from exposure to excessive volatility or security breaches.Current Law:

Under current law, New Mexico does not allow state funds to invest in digital assets such as bitcoin. The state treasurer and investment council primarily invest in traditional assets such as bonds, equities, and real estate.

-

Bill Documents arrow_drop_down

-

Commitee Reports & Amendments arrow_drop_down

-

Floor Amendments arrow_drop_down

-

Floor Votes arrow_drop_down